Blogs

Once we strive to provide a wide range of also provides, Bankrate doesn’t come with information about all of the financial or credit unit otherwise services. After you’ve added the fresh card, their bank or card issuer have a tendency to make sure the fresh cards. For individuals who increase the amount of than just you to definitely credit or debit card, you could potentially prefer a standard card and that is utilized instantly for all transactions if you don’t come across a new cards prior to making a payment. Mobile payments have numerous layers from dynamic encryption, causing them to a highly secure solution to shell out. They’re also a lot more safer than just magstripe money, and only while the safer while the EMV processor cards payments. In reality, for those who’lso are playing with a cellular money application that have deal with ID (such as Fruit Pay), it’s probably more secure than just an enthusiastic EMV processor cards percentage.

Visit this site – Technology Guidance

Shopify’s individual Store Shell out is an accelerated checkout one conserves consumer information to own smoother repayments to the each other mobile and you can pc. So it works much like a cellular purse for the reason that they facilitates speedy mobile visit this site payments when people shop on the internet. The fresh applications and you may features one to service in the-shop money all the play with anonymized tokens, otherwise encoded models of the credit card count. The actual amount is not transported, making it actually safe than handing over their plastic material.

Pursue Individual Consumer

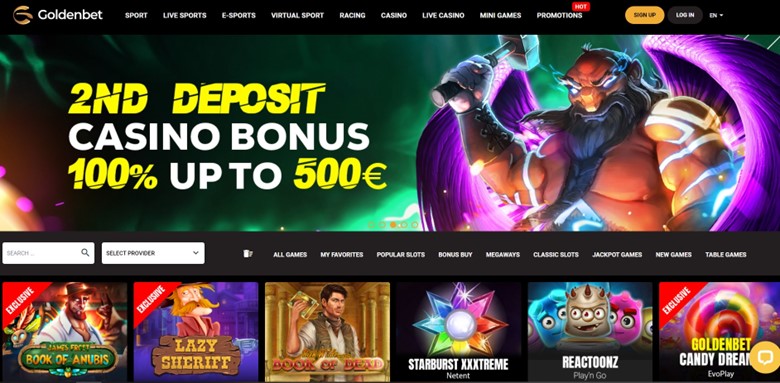

Our best choice is Monster Gambling enterprise, giving an excellent welcome added bonus, you could along with see our very own complete set of the brand new gambling enterprises you to deal with Spend Because of the Mobile phone lower than. All of our package out of security measures can help you include the information, currency and provide you with peace of mind. Find out how our company is intent on providing protect your, your account and your loved ones of financial discipline. In addition to, know about an average ways fraudsters are using so you can remain one-step just before them. When you see not authorized charges otherwise faith your account are jeopardized call us right away in order to report ripoff. Browse the Pursue Auto Education Center to get vehicle information from a reliable origin.

Tips Deposit playing with Pay because of the Cellular telephone

Following, keep your own iphone otherwise Apple Check out nearby the percentage critical to initiate the brand new payment. Apple Spend can be used during the super markets, dining, gas stations and you will shops and for many techniques from vending hosts in order to teaches and you will taxis. Merely come across the overall contactless percentage icon and/or certain Fruit Spend symbol to learn if you’re able to have fun with Apple Pay in the a particular fee terminal. Yahoo Purse often release the camera for taking a photograph of the card in order to rapidly are the facts, however you also provide the opportunity to go into the info by hand. The bank might need that you make sure the identity to do the final action from including the fresh credit to the wallet. Some of the applications and features right here enable you to enter into respect system guidance to allow you to keep accruing the individuals prize items.

All of our associate partnerships do not dictate our analysis; i continue to be impartial and you can sincere in our advice and analysis therefore you can enjoy responsibly and well-informed. We are serious about creating in charge betting and elevating feel regarding the the new you can risks of gambling dependency. Playing might be leisure, so we need you to prevent when it’s perhaps not enjoyable anymore. Playing is going to be addicting, that may impact your life considerably. Delight search professional help for individuals who otherwise someone you know are showing problem betting signs. Writers and you will publishers and create article quite happy with the goal to render precise and you can unbiased information.

- Such, all american Display and Barclays cards is actually offered.

- Your current options during the T-Cellular boil down in order to Go5G, Go5G And and you will Go5G Second agreements, however, there are less costly Essentials agreements, available, also.

- You will want to talk with an efficient attorneys or accountant authorized to practice on your own jurisdiction to possess suggestions about your particular condition.

- Fruit Shell out runs on the iphone (type six otherwise brand new), and the Apple View.

- To check on should your cards is actually contactless-permitted, find the new trend-including image printed to your side or straight back of the cards.

- The consumer contains the charge card suggestions on their Fruit membership.

Come across Fitbit habits including the Fitbit Feel dos & Experience, Fitbit Ionic, Fitbit Versa cuatro, Versa step 3, Versa dos, Fitbit Charge six, Charges 5, Costs 4 and you will special enhancements away from Fitbit Charges step three and you may Versa. When you have multiple cards, you could swipe from the available notes to determine the one to we should have fun with before moving the cell phone otherwise device to the brand new critical. Earliest, check to see if the Bing Wallet app is already strung on your cell phone.

Visibility exists to the T-Mobile’s community and you may has 5G on the compatible cell phones. Bing Fi’s $65 monthly Limitless Along with package is all about just what you’ll shell out for endless investigation with lots of mobile phone providers. However the package takes care of when you are to another country and certainly will make use of your limitless text and you may study at the no extra prices. Sure, i retreat’t viewed people Shell out By Cellular local casino that will not accept cards, coupons and also specific cryptocurrencies since the fee tips. A number of the possibilities can differ depending on your nation out of home. That it hinges on the fresh local casino’s policy, which could demand a fee, plus cellular service provider could have charges for using your cellular phone costs because the a fees method.

Cellular fee software manage a link between the newest software along with your present monetary profile—if one to’s a bank checking account, an excellent debit credit, otherwise a credit card. After you’ve confirmed which connection, the brand new mobile software links to your family savings and will suffice since the a digital wallet. NFC, otherwise “contactless,” costs is actually money you to definitely occur in person between a mobile device and an armed payments processor chip. And make a contactless percentage, you should have a cellular wallet app on your unit, otherwise play with a good contactless-let credit otherwise debit cards (can find out if their credit is contactless enabled here). And also to accept an NFC cellular commission at the company, you would like a payments reader (including the Rectangular Reader for contactless and you will chip).

Of several commission apps and services let you split an installment—merely go into the full matter and all the brand new connections that need in order to processor inside. Needless to say, they should be signed up with the brand new commission provider you might be playing with. PayPal along with enables you to send currency right to most other PayPal users much more than simply two hundred nations around the world, without the need for banks, or dollars find-up. To own in the-store costs, Samsung Shell out functions within the 17 regions not in the All of us, and you will Google Spend works in the united kingdom, along with the us. Apple Shell out work inside twenty-six countries’ areas, but people-to-person costs simply work with Us profile. By far the most buzzworthy cellular commission option is fellow-to-peer costs, while the exemplified by Venmo.

Fruit has one to Apple Spend “works with some of the big borrowing and debit notes away from the major banks” global. You can find more than 5,three hundred private creditors listed on Apple’s directory of Apple Pay acting financial institutions. So, you’ll be confident their lender is on the list, when it’s a primary lender otherwise a local borrowing from the bank union. By 2027, it’s expected you to international people often spend $six,007 billion a-year having fun with cellular payments. Economic analysts assume so it profile so you can more multiple within the second five years.

Very first everyday purchases only require one has a straightforward-but-effective application, however, if you’re looking for far more capability, the new repaid-to possess alternatives will be worth a glimpse. The consumer contains the mastercard information on the Fruit account. Users can also easily post cash to one another through an iMessage, or by simply inquiring Siri, the newest electronic assistant. Once you get the bucks, it goes to the Fruit Pay Cash harmony, that is after that moved to your bank account. Unsure if you want to withdraw money for the borrowing from the bank cards, discover a merchant account which have an e-bag, otherwise deposit that have Bitcoin? We recommend you here are a few all of our guide to on-line casino commission tips.

To pay having Fruit Shell out, add one debit otherwise mastercard to your Handbag app to your the device. Once you’re during the a store one to allows Fruit Spend, keep the ios unit over the costs viewer if you are holding their thumb to your Contact ID button. An excellent contactless cellular phone fee is a type of fee produced having fun with a mobile device and an electronic digital purse, QR password, otherwise tap to expend.

There are two main cons to presenting digital wallets than it is to cash otherwise a physical credit. That’s because they’re also performed on the mobile phones one have a tendency to need some form from verification, generally in the way of a fingerprint, facial recognition, otherwise a great passcode. The newest products along with encrypt the microbial infection, offering theft a very minimal danger of intercepting customers study. After you get paid, really apps store your finances inside the a clinging set, a sort of limited family savings.

- Discover more about as to why bettors favor shell out by cell phone casinos, the benefits from transferring having fun with cellular asking, the most used spend by the mobile phone organization, and you will and this web based casinos undertake it banking means.

- NFC, or “contactless,” repayments are costs you to occur in person ranging from a smart phone and you will an equipped repayments processor.

- Within this an extra otherwise two, your own percentage guidance might possibly be sent on the lender.

- Bing Bag is the digital purse alone and Bing Pay try the new software giving your immediate access on the Yahoo Purse, so the a couple of go in conjunction.

- Creditors techniques cellular money on the blink away from a close look.

Because the another token is made for each the new purchase, it will help to protect your details. You can include a credit or debit credit of more than 200 banking institutions and you may credit unions one assistance Fitbit Spend. After which Fitbit Shell out can be utilized anywhere the thing is the newest touchless commission symbol. After you swipe a charge card’s magnetic stripe, it’s easy for an excellent skimmer to collect all the study that’s needed to imitate the bank card. No credit card is the best option for all family members, all of the purchase or all finances. We have selected a knowledgeable handmade cards in ways built to function as the most helpful to the new largest kind of clients.